Science is an ever-expanding horizon of knowledge. Many of the new and accepted theories of modern physics have direct relevance to understanding market behaviour. Modern fractal theory, for example, gives us a new understanding of complex structures in nature that are built using a simple base structure that is then repeated in many degrees of size.

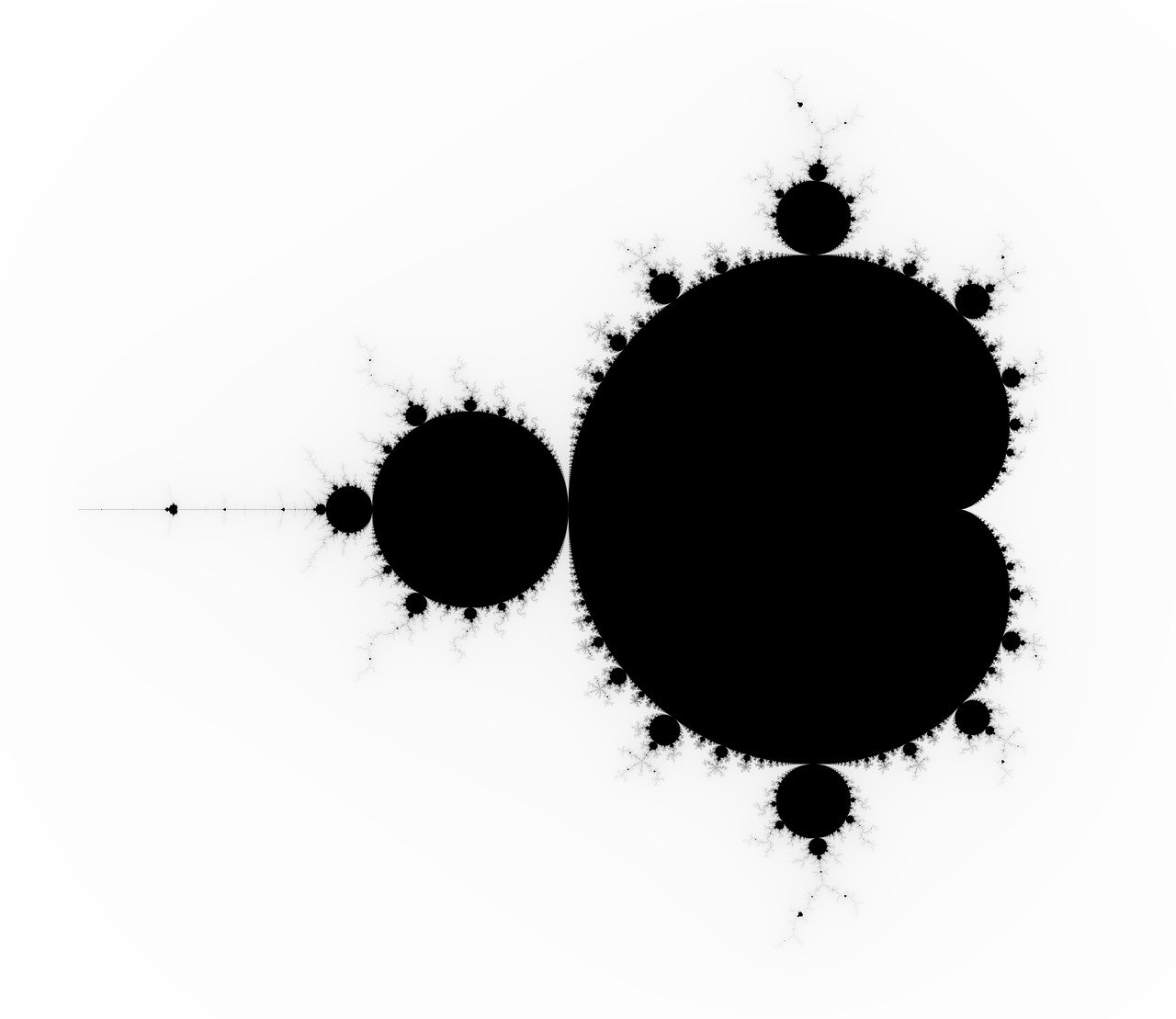

Fractals were given their name by the Polish-born mathematician Benoît Mandelbröt who described them as ‘bottomless wonders that spring from simple rules which are repeated without end’. As such, they are exquisite structures produced by nature, in evidence all around us. They are geometrical shapes made up of smaller and smaller copies of themselves, creating a mesmerising 'self-similarity' that is infinitely deep. They are tricky to define precisely, although most are linked by a set of four common fractal features: infinite intricacy, zoom symmetry, complexity from simplicity, and fractional dimensions. There are numerous examples such as snowflakes, cauliflower florets, branching river systems, flowers, trees and lightning strikes.

The perfect example is an intricately detailed fern, which is mostly built up from the same basic shape repeated over and over again at ever-smaller scales. Most astonishing of all, fractal mathematics reveals that this humble fern leaf is neither a one- nor a two-dimensional shape, but hovers somewhere in-between. Perfection in fractal structures (although nature comes pretty close) is only seen in mathematical or computer-generated fractals such as the Mandelbröt set (in black top RHS).

One practical example that recently caught our eye is that the branching river system of the Nile Delta was so clearly based on fractal dynamics that archaeologists looked for missing fractals to deduce how ancient Egyptians might have modified river channels when building pyramids nearby.

In looking to explain market behaviour, my thesis was that any pattern recognition system that was applied to markets that were fractal would, in all probability, be a closer fit to the real underlying human collective behaviour than a system that was not fractal. In that regard, there is only one that I am aware of today that is fractal, which is Ralph Nelsons Elliott's work on Elliott Waves.

Elliott Wave theory was evolved in the 1920s based on data from the stock market dating back 75 years. Elliott was able to conclude that the financial markets do not move randomly. Rather, they follow repetitive cycles in alternating waves. In short, during an uptrend, there will be large upward movements that will be occasionally opposed by smaller downward movements. In the same way, during a downtrend, there will be large downward movements by price accompanied by smaller upward movements. Elliott concluded that these cycles resulted from mass psychology. From these observations, Elliott was able to formulate an outstanding trading method that remains one of the most powerful trading approaches to this day. Elliott Wave theory also incorporated Fibonacci ratios in the natural harmonics of the way corrective waves were mathematically related to the impulse waves. Lastly, the Elliott Wave can be thought of as a very comprehensive language to describe market behaviour. For over 30 years, Global Forecaster has successfully used Elliott’s wave pattern analysis as the basis for its market predictions.

Since the Elliott Wave theory was created, there have been major advances in modern physics. One of which is in quantum mechanics which has grown significantly since then, suffusing our modern philosophy with its construction of a universe with infinite possibilities and probabilities. In essence, as we stand at a point in time, an infinite array of probabilities are stretched out in front of us in a probability field. What we then want to identify is the most likely probabilities and then point at which one pathway has a much higher chance of manifesting than all the others. In this regard, the Elliott Wave also comes into its own as every wave count has provability attached to it, and there are times when one pathway is more likely than the others, making the application of risk a positively biased outcome.

Quantum Entanglement The development of quantum theories has birthed new technologies that will change our world. The theory of quantum entanglement is one truly fascinating element. It describes the concept of how two connected photons that become entangled by proximity and which subsequently become separated by any distance will still be connected, such that, what happens to one photon will be instantly represented by the other photon. The products of this theory and its applied technologies will be numerous, from instantaneous comms to new sensors/radars that will see stealthy objects. Add in the quantum theory of the birth of the universe from a single point where all matter was in proximity, then the implication is that the whole universe is entangled and connected.

Swapping topics completely and reverting back to my first weeks at JPMorgan, I swiftly surmised that markets comprise a human collective that processes information and then acts emotionally rather than logically. The net sum of that emotional behaviour is the price of a market. Thus, the study of price patterns represents the most complete net sum of the collective awareness at any one time. Since then, my 35-year career in the market has built on that initial observation. What was missing was a mechanism as to how the collective communicated and processed information. The first obvious one is via the link to the price, as every participant reacts to its movement. However, I have often believed the shared collective emotions of humans demonstrate an instant, dynamic link. The theory of entanglement would explain this human connection.

If correct, then each person in a human collective represents a qubit, each storing a mass of information. Each person is then connected and the price of a market represents the net sum of a human biological quantum computer that is evaluating a market price and outputting the information with one output (at the time of measurement) in the market price. The price pattern recognition system that we use to predict markets and geopolitics represents this process by producing a spectrum of possible outcomes. When the probability of one outcome becomes more likely than any other, an accurate prediction and investment can be made.

The Future I have no doubt that as quantum computers come online, their base system of quantum mechanical computation will match the reality of the universe and that many new mysteries will be unlocked. One of which will no doubt be the translation of Elliott's patterns into a mathematical algorithm that will, in essence, quantify human behaviour unlocking and predicting human collective behaviour with an accuracy currently dreamed of.

INTRODUCTION TO GLOBAL FORECASTER’S SERVICES

Global Forecaster was founded to help our clients navigate an exceptionally challenging decade ahead. A prediction based on the simultaneous confluence of a series of geopolitical events – accurately predicted in our book Breaking the Code of History 15 years ago, where humanity will face a decisive moment of catastrophe or consciousness – is now upon us.

Our clients include some of the largest financial institutions in the world, asset managers, family offices and companies. All of which value our unique perspective based on collective behavioural models and their impact on markets. These constructs have been developed over three decades, with origins that date back to David Murrin’s pioneering work at JP Morgan in the 1980s. Based on recognising deep-seated ‘behavioural patterns’ in human systems, our models have predicted geopolitical and market events with an accuracy that many would not believe possible. Our remarkable geopolitical and financial market track records date back as far as 2001.

By applying cycles within history using our unique Five Stages of Empire Model, we can locate the position of any nation in the present day and then predict its behaviour across various domains and timeframes. Murrinations Insights

We then combine our geopolitical model with a multiple timeframe analysis of financial and commodity markets (80 markets and 120-plus shares), to provide accurate market timing for asset managers and to time the impact of larger-degree geopolitical events. In so doing, we can transform multi-variable complexity into the simplicity of first-order effects. This is then actionable by each of our clients, allowing them to be forewarned and empowered to navigate through these turbulent times while recognising emerging profitable opportunities before others. Financial market insights and predictions