Murrination of the Week, analysis and predictive articles on the unfolding world, before and as it happens, every Sunday at 9am.

THE BIG EQUITY BEAR IS BACK

Global Forecaster’s Theories on Human Systems, which we also call the "physics of humanity", provide a unique basis to understand and predict the way our human world is currently unfolding.

Why Do Our Subscribers Follow Us? Our theories on Breaking the Code of Markets sit underneath the bigger theories of human systems, allowing us to predict markets in ways that many do not believe is possible. To that end, our Murrinations focus on big geopolitical dynamics that feed through to impact our everyday lives. Simultaneously our CIO’s View, which is for market investment professionals, has successfully predicted the majority of the main movements and trends of the seven sectors of the macro complex, providing real-time tradable recommendations that have proven to consistently generate significant amounts of Alpha.

1.0 Geopolitics and Markets are Inextricably Bound Together

Whilst for the past decade there has been a general dislocation between geopolitics and markets, that is certainly not the case today. Why? Because we are living through a period when the C wave of the current K wave cycle is driving the ongoing commodity price and input surge, which is fuelling inflation. A cycle that we describe as highly entropic and which is generating an inextricable link between geopolitics and markets, and will continue to do so into a very extreme peak between 2025-27. A peak that has echoes of 1975, but of a much greater magnitude.

2.0 Entropic Predictions Ahead

With this understanding, we were able to predict the current surge in entropy across the human world from the commodity price lows of April 2020. These first manifested in commodity prices, feeding through to the rise in inflation, and allowed us in October 2021 (five months before it happened) to predict that Putin would invade Ukraine. Recently, in our Murrination Energy Prices to Surge In the Months Ahead we reaffirmed our prediction that oil had finished its correction and energy prices would surge, fuelling inflation. And indeed that is coming to pass, as they have moved from the WTI $65 low to $95, which is just the beginning of our predicted move to above $200 and even to $300 by 2025-27.

3.0 The Blindness of Linear Economic Thinking

In contrast, the conventional linear thinking, which has dominated the central banks and the world of finance, continues to be a desperation to justify that the inflationary surge has been an anomalous blip. A perception seen through glasses that are defined by a limited, linear thought process led them to be surprised by the surge in the first place. One that will ensure they continue to be surprised by a world they do not understand has exploded outside of the limited boundaries created by the linear economical construct of two decades of money printing. Yet only in the past week, the central banks have declared that they could stop raising rates as inflation had been brought back under control. In a moment of timing that would be laughable if its consequences were not so serious. Once more the central bankers have proven the best reverse indicators as to what will happen next.

4.0 Major Bond Market Decline Ahead

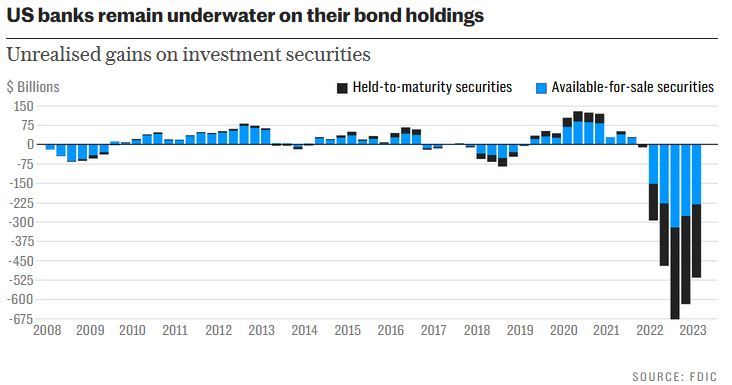

In line with our CIO’s View predictions, bond prices, especially at the long end of the maturity curve, are reacting to higher oil prices – even as the central bankers are not. Curves that were inverted (with lower interest rates for longer maturity dates) are now exposed to a violent normalisation process as yield curves rapidly steepen. A move that will ultimately see long-end rates move up to levels so much higher than today's. This means that long-dated bond prices will fall sharply and yields rise. Severely hurting companies with debt needing to be refinanced, and the property markets, whilst putting huge pressure on national debt programs, which will in all probability lead to G7 defaults.

As bond prices fall, bank reserves will collapse en mass (as many have 25% of their capital in long-dates bond books), whilst the weak banks see reductions in deposits. Destroying any semblance that they are solvent. Just watch Bank of America and SocGen as bellwethers. In short, the Western financial system is in deep doo-doo. This is the point where it reaps what it has sown after 20 years of irresponsible money printing.

5.0 Equities Ripe to Collapse

Which brings us to equities markets, which have corrected higher most of the year based on the belief that the inflation surge was anomalous and the world would soon return to money-printing normality, and about to be shocked as bond yields rise. However, the US and EU indices have all made significant highs in July/August and are now extremely exposed to a precipitous fall in the days/weeks ahead before year end.

Please note that this (or any) Murrination is not a recommendation to sell or buy. That information is only provided in our CIO’s View, which focuses on not only directional predictions but very specific market timings, to ensure low-risk, high-reward entry points to our trade reconsolidations. Indeed, we set our short positions in bonds and equity indices at much higher key levels, which means that today they are already deep in the money.

So if you are an investment manager and would like more information to maximise your performance please contact us.