Yesterday, Trump escalated his trade war to a global scale, implementing an economic policy driven by delusion—one that may well be the final nail in the coffin of the American empire. In direct contradiction to his promise to "Make America Great Again," his actions will instead impoverish Americans, weaken the nation, and leave it vulnerable to China’s growing aggression. Please read Trump 13: The 43 Days That Doomed America to Terminal Decline | David Murrin for key context.

1.0 Trump Liberation Day: A Blow to American Wallets

Trump Liberation Day will only liberate one thing: American wallets of their money. In a televised address from the Rose Garden of the White House, Trump declared, “This is one of the most important days, in my opinion, in American history.” However, not for the reasons he claimed, as there is no such thing as "Economic Independence" in today’s interconnected world. The U.S. operates as a shadow empire that projects military power, and uses dollarization to funnel revenues back to its financial centres which facilitates its massive and ever expanding debt burden.

2.0 Trump's Misguided Justification

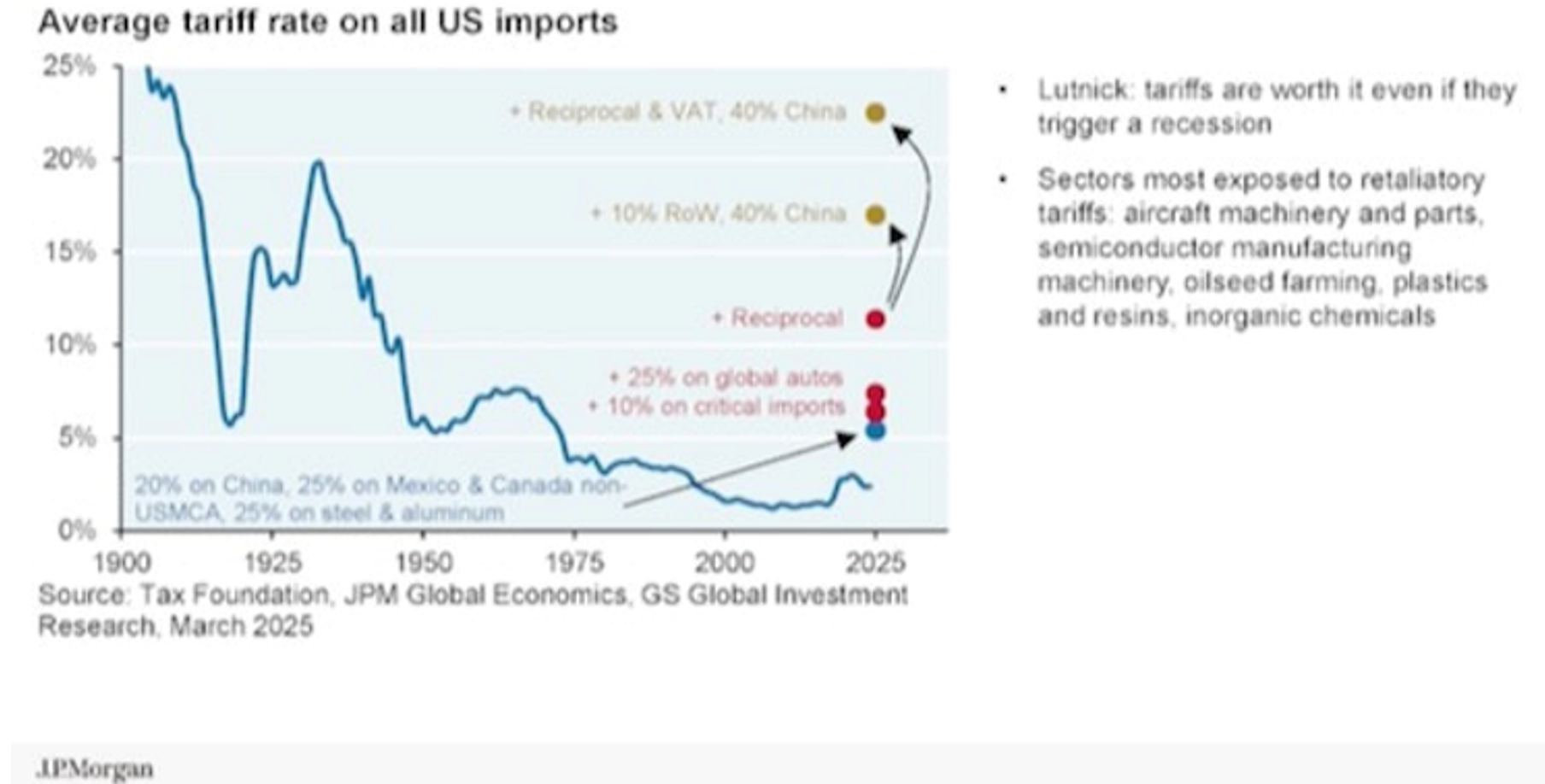

Trump justified the tariff increases by citing the U.S. trade deficit, claiming they would correct imbalances caused by excessive imports. He argued that tariffs would boost domestic manufacturing and pressure other nations to lower their own tariffs on U.S. goods. The reality is that the U.S. economy is highly leveraged and increasingly fragile.

3.0 Trump's Victim Tariffs

Trump’s tariffs are merely an extension of his narcissistic persona, using victim dynamics to manipulate public perception. He thrives on creating enemies to rally the American people, and in this trade war, he has made the world his adversary.“Taxpayers have been ripped off for more than 50 years,” Trump claimed. “But it is not going to happen anymore.” He framed the tariffs as “reciprocal,” stating, “That means they do it to us, and we do it to them.” Trump announced sweeping “reciprocal” tariffs on America’s trading partners, aiming to reverse the U.S. trade deficit.“April 2, 2025, will forever be remembered as the day American industry was reborn, the day America’s destiny was reclaimed, and the day we began to make America wealthy again,” Trump proclaimed. “For decades, our country has been looted, pillaged, raped, and plundered by nations near and far. Both friend and foe alike.” Ironically, the very system Trump seeks to dismantle has been the foundation of American economic power, making this one of the greatest acts of economic self-sabotage in history.

4.0 The New U.S. Tariff Regime

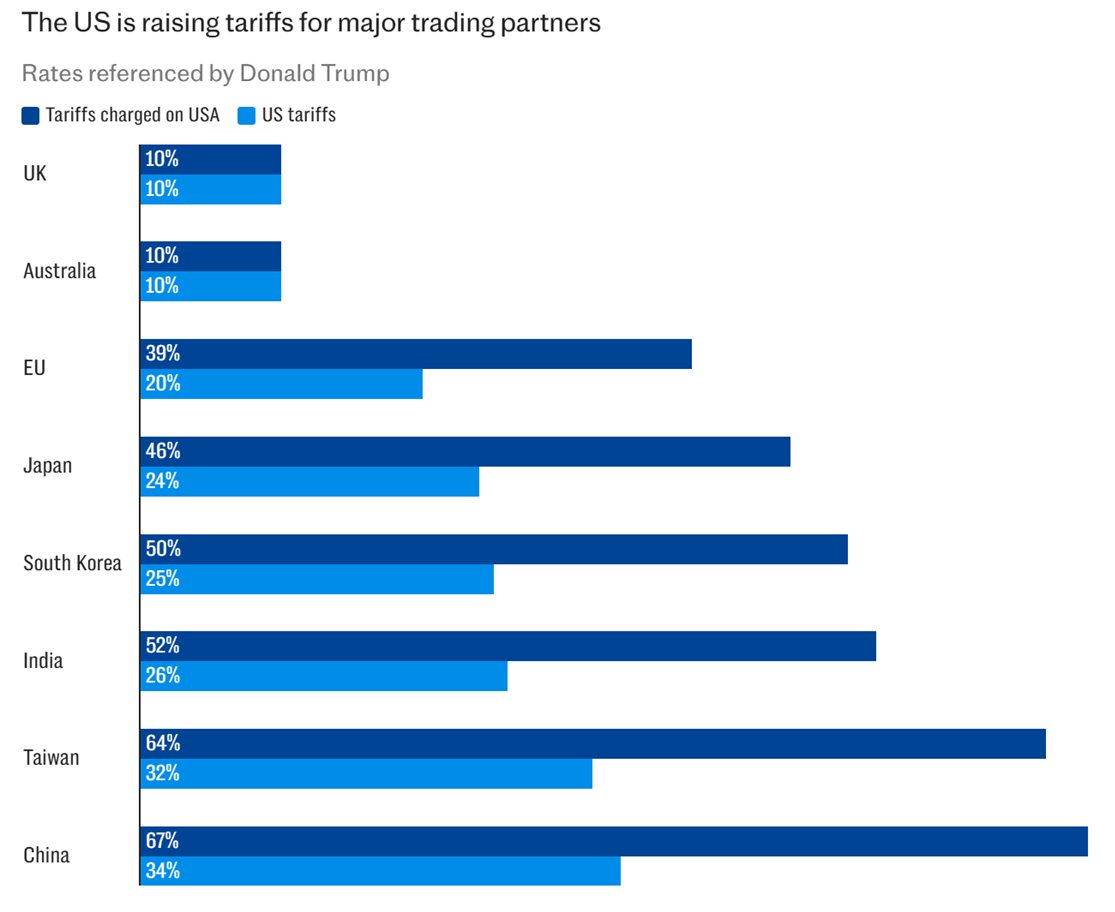

Trump announced a 10% baseline tariff on all imports (affecting the UK, Brazil, and Singapore), while a 25% tariff on all foreign car imports took effect at midnight. Additionally, certain countries deemed "trade offenders" faced higher levies, according to a table that summed up each country's misdemeanours in the eyes of Trump and netted them out as so-called charges on US imports.

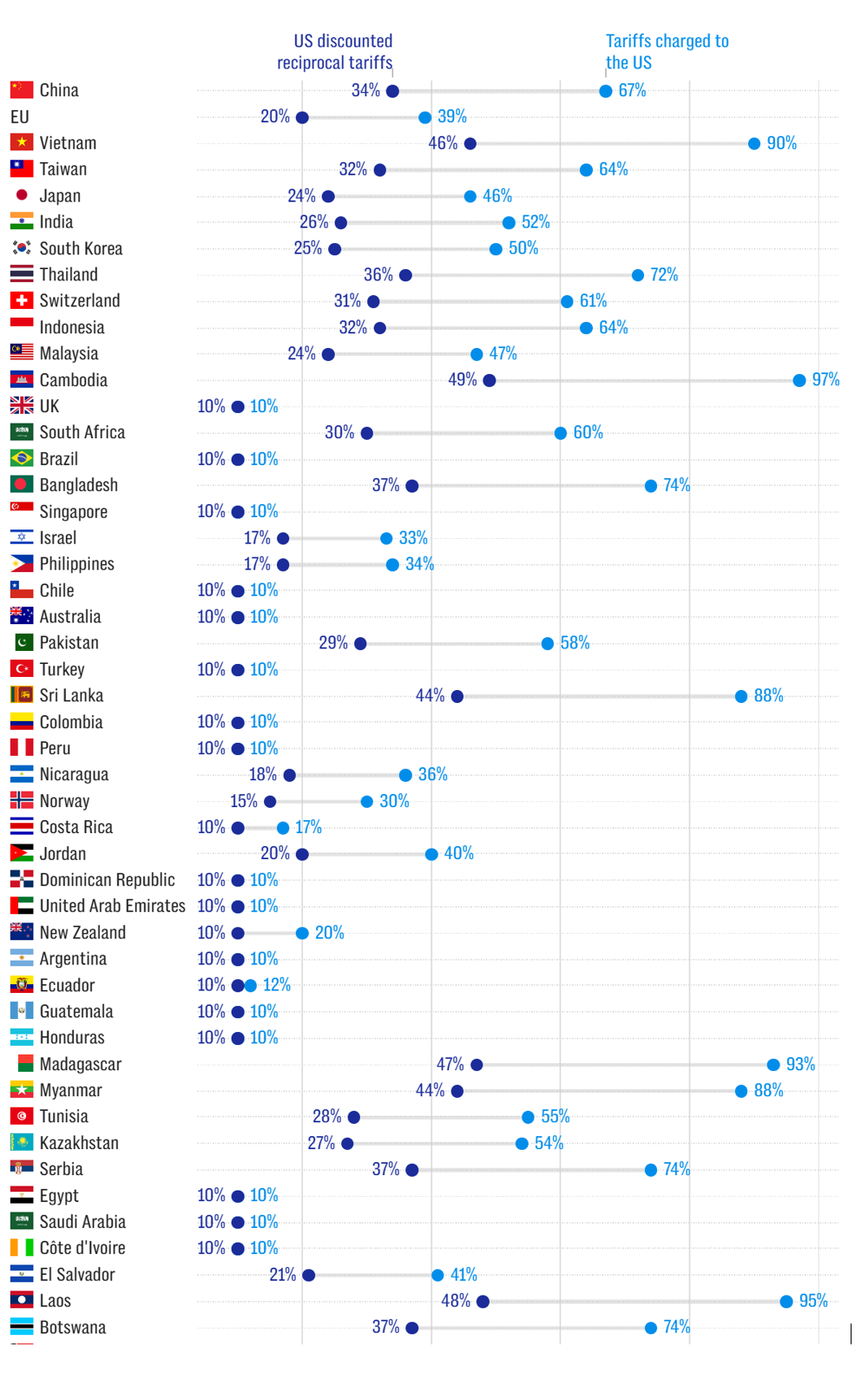

Trump declared, “In many cases, the friend is worse than the foe regarding trade. We subsidise a lot of countries and keep them going and keep them in business.” The larger table of percieved misdemeanours is shown below;

5.0 Trump's Not-So-Beautiful Tariffs

Trump has imposed tariffs on $3.83 trillion worth of imported goods and services, primarily from China, Mexico, and Canada. In 2023, the U.S. imported $426.9 billion worth of goods from China and $475.2 billion from Mexico. Applying a 25% tariff, the U.S. government will initially generate $700-800 billion in revenue, but ultimately, this burden will fall on American consumers. The theory is that tariffs will force substitution, leading to a domestic manufacturing boom. However, Trump claims the U.S. will soon produce the "cars, ships, chips, minerals, and airplanes we need right here in America", but this approach relies on coercion rather than incentive. A more effective strategy would be tax benefits for new manufacturers rather than punitive tariffs.

6.0 Will There Be an American Industrial Resurgence?

Trump has pledged to cut corporate tax rates from 21% to 15% (which will not be enough carrot when balanced against Trump's entropy) for U.S.-based production, encouraging companies to relocate operations. However, any benefits will take years to materialise, leaving the economy vulnerable in the near term. With growth slowing and uncertainty mounting, the economic outlook remains bleak, as Trump's policies exacerbate the fragility of a super overleveraged U.S. economy.

7.0 The Impact of Even 10% Tariffs On The UK

Even a 10% tariff will be devastating for businesses operating on thin margins. Stephen Phipson, chief executive of industry body Make UK, warned:"The US President’s announcement of 10% tariffs on UK goods, along with 25% tariffs on British-made autos, steel, and aluminium, is devastating for UK manufacturing. Not only will direct exports to the US decline, but decades of integrated supply chains will be severely disrupted." ** Without a formal trade agreement, the UK and US have long enjoyed a balanced trade relationship based on mutual collaboration and investment. Phipson added:"It is highly disappointing that instead of enhancing free trade, these tariffs will have immediate negative consequences, not only for UK industry but also for U.S. consumers and the broader American economy."

8.0 The End of Globalization And The Collapse of The Dollar

The End of Globalisation linked to Pax America came back in 2019 when the globalisation index peaked. However Trump has now engineered an acceleration of the subsequent fall related directly to the implosion of Pax America as outlined in The Cycle of Globalisation 1; The Link to Hegemony | David Murrin through to The Cycle of Globalisation 4: Contraction on the Road to WW3. The reality is that the health of the Dollar and the phase of globalisation are inextricably linked. Indeed, the dollar has declined since its peak in September 2022, which we called precisely in Global Trader: Your External CIO | David Murrin. Since its secondary high into Trump’s inauguration in January 2025, it has now started a major 20-30% decline. Put simply, the US dollarisation footprint shrinks, in line with the contraction of the American empire. This process will keep accelerating, and we will see a rapid 20-30% dollar fall with sterling targeting initial 1.70.

9.0 Trump Is Collapsing the U.S. Economy

The U.S. is heading toward a 1929-style crash. With leverage estimated at 40X, the economic shock will be far greater than anticipated:

- Stock markets will collapse, and liquidity will dry up.

- Tariffs will raise inflation, far higher than the official CPI index suggests.

- Interest rates will rise, and the increasing American debt burden will soon cancel any tariff revenues.

- Bond prices will plummet, worsening the U.S. fiscal deficit in a destructive feedback loop.

So far, we have accurately called all elements of the global market macro complex, including the exact high in Bitcoin at 109.00. So, if you are a professional asset manager and seek more information on our market views, please reach out Contact

10.0 The Devil's Trinity of Imperial Decline and The Collapse of the U.S. Empire

The simultaneous decline of U.S. bonds, equity markets, and the dollar will mark the next stage of the American empire's final economic collapse.

11.0 Counter Tariffs: Global Retaliation Begins

Canada and China have already imposed retaliatory tariffs, though their impact remains smaller than the U.S. measures:

- Canada: $42.7 billion in tariffs (15% of total U.S. imports)

- China: Tariffs on U.S. agriculture, oil, and timber

- EU: $26 billion in tariffs, despite threats from Washington

The world now awaits further retaliatory measures, deepening the trade war.

12.0 China's Response: A Path to War?

There is growing concern that the 34% tariffs on China will push its fragile economy further into decline, as Beijing nears the end of its five-year "go bust or go to war" strategy. Trump's tariffs could become the tipping point, much like the U.S. oil embargo on Japan in 1940, which ultimately forced Japan into war as economic collapse loomed. In a historical parallel, the U.S. gradually escalated its economic war against Japan as tensions grew over its expansion in Indo-China:

- July 1940: The U.S. imposed a partial embargo on aviation fuel, steel, and iron.

- August 1, 1941: The U.S., alongside Britain and the Netherlands, froze Japanese assets and implemented a full oil embargo, cutting off Japan’s vital energy supply.

- Impact: Japan had only 1-2 years of oil reserves left, crippling its ability to sustain military operations. Faced with a dire choice—withdraw from its conquests or secure new resources by force—Japan saw war as its only option.

- December 7, 1941: Japan attacked Pearl Harbor, aiming to cripple the U.S. Pacific Fleet and secure the resources it needed for survival.

Instead of coercing Japan into changing its policies, the embargo pushed the country into war. With China now facing a severe economic squeeze under U.S. tariffs, history may once again be repeating itself—with potentially catastrophic consequences.

13.0 Key Takeaways from Past Trade Wars:

Trade wars are highly entropic, creating economic hardship for all sides. In many ways, they are self-ignited forest fires that are impossible to control once in full swing and everything in their path burns. Add in some ferocious winds, which I would describe as the increasing entropy cycle into 2030, and you get the perfect firestorm to end the American Empire, even without a fully blown WW3. There are clear lessons from over 100 years of trade wars that Trump seems not to have learned

- Retaliation is inevitable.

- Tariffs harm domestic consumers and businesses.

- Trade wars rarely achieve their intended policy goals.

- Diplomatic and tax-based solutions are more effective than economic warfare.

- Sanctions and tariffs often backfire, strengthening adversaries instead of weakening them.

Articles and commentary post publication

8 April 2025 Trump's Trade War is About Control and Will Only Escalate

Trump’s trade wars were never about protecting American workers or reviving struggling industries—they are a display of raw power. This unfolding war is driven not by strategy but by Trump's spite, serving more as a tool to intimidate allies, provoke adversaries, and bend global markets to his will than to secure fairer trade deals.

Trump made no secret of his intentions. From the outset, he campaigned on chaos, promising to upend institutions, punish enemies, and assert himself as a strongman. He admired authoritarian rulers, relished the idea of unchecked authority, and consistently prioritised personal loyalty over democratic principles or economic stability. His disregard for truth and democratic norms was never hidden, yet over 77 million Americans still voted for him. His promises—to lower prices, cut taxes, and end wars—were hollow from the start. What he truly sought was control, not prosperity. He didn’t want to lead America; he wanted America to obey.

This pursuit of control is playing out once again in Trump’s latest escalation of his trade war with China. After Beijing imposed 34% tariffs on U.S. goods, Trump threatened to retaliate with tariffs that could exceed 100%, pushing total tariff rates on Chinese imports as high as 115%. These Trump threats come despite already damaging economic fallout, including ballooning trade deficits and rising costs for American consumers.

Investment bank Citi previously estimated that Trump’s tariff measures—spanning both his terms—could drive effective tariff rates on Chinese goods to around 65%. Now, Trump’s aggressive rhetoric signals a move to double that figure. On his Truth Social platform, he warned that if China does not withdraw its new tariffs, the U.S. will impose additional 50% tariffs, on top of those already in place. The market has responded with panic. The S&P 500 has plunged more than 20% from its December peak, officially entering bear market territory after losing more than 13.5% since Trump’s announcement of his “Liberation Day” tariffs. A staggering $9.5 trillion has been wiped from global stock markets, according to Bloomberg. Despite the economic carnage, Trump continues to urge Americans to “be strong, courageous, and patient,” promising that “greatness will be the result.” But the reality is clear: these trade wars, launched without foresight and sustained through belligerence, have left economic destruction in their wake—and the world is once again paying the price.

What is certain is that this trade war will only escalate in terms of the magnitude of the tariffs and the next step into a kinetic war with China.

7 April 2025 China Retaliates with a seven-element Rare Earth Moratorium on Trump

Two days after U.S. President Donald Trump announced a 34% tariff on Chinese products, Beijing retaliated with new controls on critical mineral exports, targeting the American defense-industrial base while also matching levies on U.S. imports. Effective immediately, China will require special licenses to export seven medium and heavy rare-earth elements to the U.S.: dysprosium, gadolinium, lutetium, samarium, scandium, terbium, and yttrium. China’s Ministry of Commerce stated that the export curbs were imposed “to better safeguard national security and interests and to fulfil international obligations such as non-proliferation.”

Beijing’s selection of minerals was calculated carefully. The U.S. is highly dependent on China for these metals and lacks the ability to produce them at scale domestically, even in cases where significant domestic deposits exist. “This is a precision strike by China against Pentagon supply chains that support our most powerful weapons and defence systems,” said Mark Smith, CEO of NioCorp, a company developing a critical minerals project in Nebraska.

At the same time, Beijing is applying direct pressure on the defence sector’s permanent magnet supply chain. Terbium, for example, enhances the temperature resilience of neodymium iron boron magnets. These magnets have crucial defence applications, including in missile guidance and control systems, satellite communications, and radar systems. Lockheed Martin’s F-35 Lightning II, General Atomics’ Predator drones, and RTX’s Tomahawk missiles all use rare-earth magnets. The magnets are also essential components of Virginia- and Columbia-class submarines.

China produces nearly 100% of the world’s dysprosium, which is used to improve the properties of neodymium magnets, making them resistant to demagnetisation at high temperatures. Dysprosium’s heat resistance also makes it vital for advanced semiconductors. By curbing exports of gadolinium to the U.S., China disrupts the aircraft engine supply chain. Gadolinium is used to enhance the mechanical properties of alloys in turbine blades and other engine components.

Investors have cautioned that Britain and many other Western nations (including America) risk being dragged into a debt crisis reminiscent of Greece's financial meltdown a decade ago, as Trump’s trade war threatens to weaken the global economy.

With the UK economy already fragile and the Treasury operating with minimal fiscal headroom, experts warn that Britain is vulnerable to a “negative spiral” similar to the one that gripped the eurozone in the early 2010s. At that time, bond markets turned sharply against Greece when investors lost confidence in its ability to balance the books.One investor explained: “The problem with high debt levels is that it’s manageable—as long as your nominal economic growth exceeds your interest costs. But if nominal GDP growth stalls, even slightly and not just temporarily, below the level of interest payments, you quickly enter a dangerous downward spiral. That’s exactly what happened to Greece during the global financial crisis.”

5 April 2025 -Chinese Innovation Power is Underestimated By Trump

Huawei’s Lianqiu Lake R&D campus, completed in just over three years, is a state-of-the-art facility featuring 104 buildings, 100 cafes, fitness centres, and a monorail designed to attract top talent. This campus is Huawei’s response to the U.S. tech export restrictions that began in 2019, which severely impacted the company. Despite the sanctions, Huawei has continued to innovate, introducing the advanced "Mate 60" smartphone, a triple-folding phone, and the Hongmeng operating system, all made possible by domestic semiconductor production. Huawei has also expanded into AI technology for electric vehicles and autonomous systems, including charging stations across China.

While the U.S. focuses on domestic issues, China is advancing rapidly in AI and manufacturing. Huawei’s impressive comeback in 2024, with a significant rise in profits thanks to homegrown chips, highlights this shift. The U.S. must reconsider its assumptions about China’s technological capabilities, as the country’s ongoing advancements show that China is no longer reliant on U.S. technology. This is a wake-up call to U.S. lawmakers, who need to update their understanding of China’s growing innovation and its economic impact. The narrative that the U.S. can outpace China is increasingly misguided, and tariffs will only exacerbate long-term inflation, not solve the issue.

06 April 2025 Central Banks Forced to Act Early as US Trade War Threatens Global Growth

The consequences of the president’s trade war are becoming increasingly clear. Rattled economists are slashing growth forecasts and raising the likelihood of a global recession. The timing couldn’t be worse—especially for heavily indebted governments—just as calls grow for increased public spending on benefits, healthcare, and defence. In response, central banks are being forced to play their hands early. The Bank of England’s Monetary Policy Committee (MPC) is expected to cut rates to stimulate growth, despite the risk that tariffs could reignite inflationary pressures. “They may return to the kind of approach we saw during the pandemic,” one analyst noted. “When demand looks weak, you ease monetary policy.” At this stage, policymakers appear more focused on keeping their economies afloat than fighting rising prices. Now, central banks must step in to support struggling economies. History shows that the Federal Reserve tends to cut rates aggressively during downturns—and markets are betting it will do so again.In the eurozone, markets are already pricing in three rate cuts between now and September. The European Central Bank’s (ECB) next move, expected in two weeks, will likely bring the key rate down to 2.25%, with a further reduction to 1.75% anticipated by autumn.Goldman Sachs has warned that there is a one-in-three chance rates could fall even further, depending on how quickly the economic outlook deteriorates.

GF – While central banks will undoubtedly lower rates to compensate for the decline in growth triggered by Trump’s economic madness, the next stage of this entropic story is far more dangerous: an imminent U.S. and Israeli strike on Iran’s nuclear facilities. Such an event would send oil prices soaring, ushering in a stagflationary environment—the worst of all economic outcomes. In this scenario, Trump will have not only weakened the U.S. economy but also that of its allies, precisely at the moment they face mounting pressure from Chinese and Russian aggression. His policies are nothing short of national suicide.

Not below that, Russia received zero sanctions! Hardly a good message, even though America imports nothing from Putin's empire!

As global stock markets continued their falls on Friday. The Nasdaq Composite has fallen more than 20% from its December highs, officially entering what investors refer to as a “bear market.”As anyone familiar with past trade wars could have predicted (Trump excluded!), China retaliated swiftly against the new U.S. tariffs announced on Friday, escalating fears of a broader global trade war. Beijing slammed the move as “unilateral bullying” and responded by raising tariffs on all U.S. imports by 34 percentage points—mirroring the tariffs Trump imposed on China just two days earlier. In response, Trump lashed out, accusing China of having “panicked” and “played it wrong” with its decision to slap 34% tariffs on all American goods starting next Thursday. He doubled down on his stance, calling the Chinese reaction a misstep. Amid the growing tension, Trump found solace in a better-than-expected jobs report showing U.S. employers added 228,000 jobs in March. “GREAT JOB NUMBERS, FAR BETTER THAN EXPECTED. IT’S ALREADY WORKING. HANG TOUGH, WE CAN’T LOSE!!!” he posted. Adding to his delusional worldview, Trump also claimed that Labour leader Keir Starmer was “very happy” with how Britain was being treated in the tariff dispute. But honestly—in what world is anyone happy with Trump's trade war?

3 April 2025 Trump’s Delusion

is clear after the dollar and Stock markets fell precipitously following his global tariffs. Indeed, Trump has overseen the worst 10-week start to a presidency in terms of stock market performance since George Bush during the 2001 dot-com crisis. The market turmoil extended from Tokyo to London as outraged American trade partners vowed to retaliate. Despite the downturn, Trump remained optimistic, telling reporters at the White House, “I think it’s going very well. The markets are going to boom. The country is going to boom.” Meanwhile, JD Vance, speaking on Fox News, dismissed concerns, insisting there was nothing but “enthusiasm” for Trump’s aggressive trade policies.

3 April 2025 British Columnist Blasts Trump’s Tariff Plan as Economic Self-Destruction

British columnist Ian Dunt has condemned Donald Trump’s latest tariff announcement, calling it a disastrous move that epitomises the decline of an empire. Writing for iNews, Dunt expressed shock at the economic damage Trump is inflicting on his own country.Dunt was particularly appalled by a chart Trump presented, which allegedly contained wildly inaccurate figures about foreign tariffs on American goods. He described the data as "pure gibberish," likening its logic to dividing apples by bagels to calculate a mortgage rate. Criticising Trump’s approach as intellectually and economically indefensible, Dunt argued that the policy lacked rational thought and was "the single stupidest thing" he had ever seen. He compared Trump’s presentation style to a "cheap knock-off daytime TV host," suggesting that his tariff plan was more spectacle than strategy.Dunt's critique highlights broader concerns that Trump's trade policies could lead to economic turmoil, reinforcing fears of mismanagement and decline.

8 April 2025 Trump's Trade War is About Control and Will Only Escalate

Trump’s trade wars were never about protecting American workers or reviving struggling industries—they are a display of raw power. This unfolding war is driven not by strategy but by Trump's spite, serving more as a tool to intimidate allies, provoke adversaries, and bend global markets to his will than to secure fairer trade deals.

Trump made no secret of his intentions. From the outset, he campaigned on chaos, promising to upend institutions, punish enemies, and assert himself as a strongman. He admired authoritarian rulers, relished the idea of unchecked authority, and consistently prioritised personal loyalty over democratic principles or economic stability. His disregard for truth and democratic norms was never hidden, yet over 77 million Americans still voted for him. His promises—to lower prices, cut taxes, and end wars—were hollow from the start. What he truly sought was control, not prosperity. He didn’t want to lead America; he wanted America to obey.

This pursuit of control is playing out once again in Trump’s latest escalation of his trade war with China. After Beijing imposed 34% tariffs on U.S. goods, Trump threatened to retaliate with tariffs that could exceed 100%, pushing total tariff rates on Chinese imports as high as 115%. These Trump threats come despite already damaging economic fallout, including ballooning trade deficits and rising costs for American consumers.

Investment bank Citi previously estimated that Trump’s tariff measures—spanning both his terms—could drive effective tariff rates on Chinese goods to around 65%. Now, Trump’s aggressive rhetoric signals a move to double that figure. On his Truth Social platform, he warned that if China does not withdraw its new tariffs, the U.S. will impose additional 50% tariffs, on top of those already in place. The market has responded with panic. The S&P 500 has plunged more than 20% from its December peak, officially entering bear market territory after losing more than 13.5% since Trump’s announcement of his “Liberation Day” tariffs. A staggering $9.5 trillion has been wiped from global stock markets, according to Bloomberg. Despite the economic carnage, Trump continues to urge Americans to “be strong, courageous, and patient,” promising that “greatness will be the result.” But the reality is clear: these trade wars, launched without foresight and sustained through belligerence, have left economic destruction in their wake—and the world is once again paying the price.

What is certain is that this trade war will only escalate in terms of the magnitude of the tariffs and the next step into a kinetic war with China.

7 April 2025 China Retaliates with a seven-element Rare Earth Moratorium on Trump

Two days after U.S. President Donald Trump announced a 34% tariff on Chinese products, Beijing retaliated with new controls on critical mineral exports, targeting the American defense-industrial base while also matching levies on U.S. imports. Effective immediately, China will require special licenses to export seven medium and heavy rare-earth elements to the U.S.: dysprosium, gadolinium, lutetium, samarium, scandium, terbium, and yttrium. China’s Ministry of Commerce stated that the export curbs were imposed “to better safeguard national security and interests and to fulfil international obligations such as non-proliferation.”

Beijing’s selection of minerals was calculated carefully. The U.S. is highly dependent on China for these metals and lacks the ability to produce them at scale domestically, even in cases where significant domestic deposits exist. “This is a precision strike by China against Pentagon supply chains that support our most powerful weapons and defence systems,” said Mark Smith, CEO of NioCorp, a company developing a critical minerals project in Nebraska.

At the same time, Beijing is applying direct pressure on the defence sector’s permanent magnet supply chain. Terbium, for example, enhances the temperature resilience of neodymium iron boron magnets. These magnets have crucial defence applications, including in missile guidance and control systems, satellite communications, and radar systems. Lockheed Martin’s F-35 Lightning II, General Atomics’ Predator drones, and RTX’s Tomahawk missiles all use rare-earth magnets. The magnets are also essential components of Virginia- and Columbia-class submarines.

China produces nearly 100% of the world’s dysprosium, which is used to improve the properties of neodymium magnets, making them resistant to demagnetisation at high temperatures. Dysprosium’s heat resistance also makes it vital for advanced semiconductors. By curbing exports of gadolinium to the U.S., China disrupts the aircraft engine supply chain. Gadolinium is used to enhance the mechanical properties of alloys in turbine blades and other engine components.

06 April 2025 UK risks Greek-style debt crisis from Trump tariffs

Investors have cautioned that Britain and many other Western nations (including America) risk being dragged into a debt crisis reminiscent of Greece's financial meltdown a decade ago, as Trump’s trade war threatens to weaken the global economy.

With the UK economy already fragile and the Treasury operating with minimal fiscal headroom, experts warn that Britain is vulnerable to a “negative spiral” similar to the one that gripped the eurozone in the early 2010s. At that time, bond markets turned sharply against Greece when investors lost confidence in its ability to balance the books.One investor explained: “The problem with high debt levels is that it’s manageable—as long as your nominal economic growth exceeds your interest costs. But if nominal GDP growth stalls, even slightly and not just temporarily, below the level of interest payments, you quickly enter a dangerous downward spiral. That’s exactly what happened to Greece during the global financial crisis.”

5 April 2025 -Chinese Innovation Power is Underestimated By Trump

Huawei’s Lianqiu Lake R&D campus, completed in just over three years, is a state-of-the-art facility featuring 104 buildings, 100 cafes, fitness centres, and a monorail designed to attract top talent. This campus is Huawei’s response to the U.S. tech export restrictions that began in 2019, which severely impacted the company. Despite the sanctions, Huawei has continued to innovate, introducing the advanced "Mate 60" smartphone, a triple-folding phone, and the Hongmeng operating system, all made possible by domestic semiconductor production. Huawei has also expanded into AI technology for electric vehicles and autonomous systems, including charging stations across China.

While the U.S. focuses on domestic issues, China is advancing rapidly in AI and manufacturing. Huawei’s impressive comeback in 2024, with a significant rise in profits thanks to homegrown chips, highlights this shift. The U.S. must reconsider its assumptions about China’s technological capabilities, as the country’s ongoing advancements show that China is no longer reliant on U.S. technology. This is a wake-up call to U.S. lawmakers, who need to update their understanding of China’s growing innovation and its economic impact. The narrative that the U.S. can outpace China is increasingly misguided, and tariffs will only exacerbate long-term inflation, not solve the issue.

06 April 2025 Central Banks Forced to Act Early as US Trade War Threatens Global Growth

The consequences of the president’s trade war are becoming increasingly clear. Rattled economists are slashing growth forecasts and raising the likelihood of a global recession. The timing couldn’t be worse—especially for heavily indebted governments—just as calls grow for increased public spending on benefits, healthcare, and defence. In response, central banks are being forced to play their hands early. The Bank of England’s Monetary Policy Committee (MPC) is expected to cut rates to stimulate growth, despite the risk that tariffs could reignite inflationary pressures. “They may return to the kind of approach we saw during the pandemic,” one analyst noted. “When demand looks weak, you ease monetary policy.” At this stage, policymakers appear more focused on keeping their economies afloat than fighting rising prices. Now, central banks must step in to support struggling economies. History shows that the Federal Reserve tends to cut rates aggressively during downturns—and markets are betting it will do so again.In the eurozone, markets are already pricing in three rate cuts between now and September. The European Central Bank’s (ECB) next move, expected in two weeks, will likely bring the key rate down to 2.25%, with a further reduction to 1.75% anticipated by autumn.Goldman Sachs has warned that there is a one-in-three chance rates could fall even further, depending on how quickly the economic outlook deteriorates.

GF – While central banks will undoubtedly lower rates to compensate for the decline in growth triggered by Trump’s economic madness, the next stage of this entropic story is far more dangerous: an imminent U.S. and Israeli strike on Iran’s nuclear facilities. Such an event would send oil prices soaring, ushering in a stagflationary environment—the worst of all economic outcomes. In this scenario, Trump will have not only weakened the U.S. economy but also that of its allies, precisely at the moment they face mounting pressure from Chinese and Russian aggression. His policies are nothing short of national suicide.

Not below that, Russia received zero sanctions! Hardly a good message, even though America imports nothing from Putin's empire!

5 April 2025 China’s tit-for-tat with Trump on tariffs raises fears of a fully blown all out trade war

As global stock markets continued their falls on Friday. The Nasdaq Composite has fallen more than 20% from its December highs, officially entering what investors refer to as a “bear market.”As anyone familiar with past trade wars could have predicted (Trump excluded!), China retaliated swiftly against the new U.S. tariffs announced on Friday, escalating fears of a broader global trade war. Beijing slammed the move as “unilateral bullying” and responded by raising tariffs on all U.S. imports by 34 percentage points—mirroring the tariffs Trump imposed on China just two days earlier. In response, Trump lashed out, accusing China of having “panicked” and “played it wrong” with its decision to slap 34% tariffs on all American goods starting next Thursday. He doubled down on his stance, calling the Chinese reaction a misstep. Amid the growing tension, Trump found solace in a better-than-expected jobs report showing U.S. employers added 228,000 jobs in March. “GREAT JOB NUMBERS, FAR BETTER THAN EXPECTED. IT’S ALREADY WORKING. HANG TOUGH, WE CAN’T LOSE!!!” he posted. Adding to his delusional worldview, Trump also claimed that Labour leader Keir Starmer was “very happy” with how Britain was being treated in the tariff dispute. But honestly—in what world is anyone happy with Trump's trade war?

3 April 2025 Trump’s Delusion

is clear after the dollar and Stock markets fell precipitously following his global tariffs. Indeed, Trump has overseen the worst 10-week start to a presidency in terms of stock market performance since George Bush during the 2001 dot-com crisis. The market turmoil extended from Tokyo to London as outraged American trade partners vowed to retaliate. Despite the downturn, Trump remained optimistic, telling reporters at the White House, “I think it’s going very well. The markets are going to boom. The country is going to boom.” Meanwhile, JD Vance, speaking on Fox News, dismissed concerns, insisting there was nothing but “enthusiasm” for Trump’s aggressive trade policies.

3 April 2025 Trump tariffs and Liberation Day is about ideology, not the US economy. Trump’s tariffs are the sign of a nation in decline, not becoming great again?!

3 April 2025 British Columnist Blasts Trump’s Tariff Plan as Economic Self-Destruction

British columnist Ian Dunt has condemned Donald Trump’s latest tariff announcement, calling it a disastrous move that epitomises the decline of an empire. Writing for iNews, Dunt expressed shock at the economic damage Trump is inflicting on his own country.Dunt was particularly appalled by a chart Trump presented, which allegedly contained wildly inaccurate figures about foreign tariffs on American goods. He described the data as "pure gibberish," likening its logic to dividing apples by bagels to calculate a mortgage rate. Criticising Trump’s approach as intellectually and economically indefensible, Dunt argued that the policy lacked rational thought and was "the single stupidest thing" he had ever seen. He compared Trump’s presentation style to a "cheap knock-off daytime TV host," suggesting that his tariff plan was more spectacle than strategy.Dunt's critique highlights broader concerns that Trump's trade policies could lead to economic turmoil, reinforcing fears of mismanagement and decline.